Maybe you have heard some people say that investing is for those of solid financial means. It seems to me these people forget the old saying, “Take care of the pennies, and the pounds will take care of themselves.”

Everyone can start investing without even having to set aside large sums of money.

Think about this: when you do your grocery shopping, you get back some change. What if you can use that change to start an investment and potentially accumulate a sizeable amount?

You can do that with Acorns, a financial app that helps you invest your spare change.

See also: Best Investment Apps

What is Acorns App?

Acorns is a micro-savings investment app. Many people love it is because of its round-ups feature.

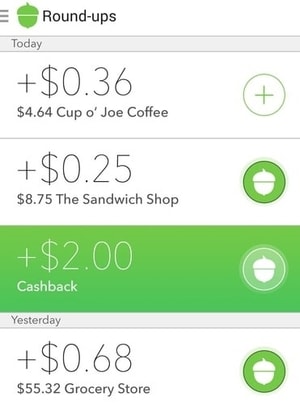

When you shop, the purchase price is rounded up to the next dollar, and the difference is channeled into diversified investment portfolios. For instance, if you spend $6.60 on an item, the Acorns app will automatically round up the price to $7, and the difference of $0.40 will be invested in your chosen portfolio.

So, you can start small and gradually work your way to financial stability. In the end, these numbers add up to something significant.

However, is Acorns as good as many people say? Is it legit and worth it? The short answer is – yes, Acorns is an excellent and legit app. Read through our review and learn all this app – core features, fees, minimum requirements… you name it, we research it.

NB! Acorns is now offering a $5 signup bonus for new accounts opened. As soon as you complete registration, they will deposit $5 into your account to get you started.

Acorns Review At a Glance

Acorns Pros

- No minimum required investment

- Automated investing

- Free for students

Acorns Cons

- Small investment portfolio

- Monthly fee $1-$3 might be relatively high on smaller accounts.

mplyBest For: Acorns is perfect for hands-off passive investors who like automated investing, and for people who would like to start investing but struggle with saving money each month.

Bottom Line: We recommend everyone to use Acorns. The Round-Ups feature is incredible, and you don’t even notice how fast it will collect around $50-100 per month like this. Moreover, if you combine this amount with the Found Money feature, which rewards you often quite well, then these numbers and compound returns will start to add up. You would be surprised who much money you might make with a couple of years like that.

Acorns Full Review

How does Acorns work?

When you use the Acorns app, your spare change is automatically invested in a portfolio of exchange-traded funds (ETFs). Key features to understand here are Round-Ups and Found Money.

Round-Ups

In other words, the money will be sent from an Acorns Core account to the linked checking account(s). When the Round-Ups reach at least $5, the amount is transferred from your bank account and then invested in real-time.

You can choose to invest daily, weekly, or monthly. You can make a one-time investment to give your account a boost if its value is low. An investment is made using the money in your Acorns account. There are various ETF portfolios to choose from, depending on the asset classes you prefer.

How does the Round-Ups feature work?

Once you register and have your account approved, the initial deposit will be withdrawn by Acorns. After that, your account will be ready for investing.

The Round-Ups transfers always come from the spare change from your daily purchases. It will be added to the Round-Ups balance. You are the one who decides what types of transactions to include in your Round-Ups. You can opt to make it automatic, which means all your transactions will be eligible for Round-Ups. You can also massively boost your account by depositing your cash reward bonuses.

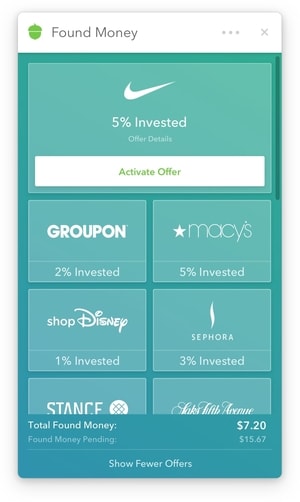

Found Money

There are currently two types of promotions under Found Money: Simply Spend and Tap & Get.

With Simply Spend, you have to make a purchase using the Round-Ups account, while Tap & Get requires transacting via the Found Money link available in the Acorns app. Both promotions come with some conditions attached. These include subscriptions and a particular minimum purchase order.

Therefore, it is essential to follow the requirements to qualify for the Found Money promotions. Acorns invests your money in smart portfolios, enabling you to choose the kind you are comfortable with. The Acorns portfolios range from conservative to aggressive.

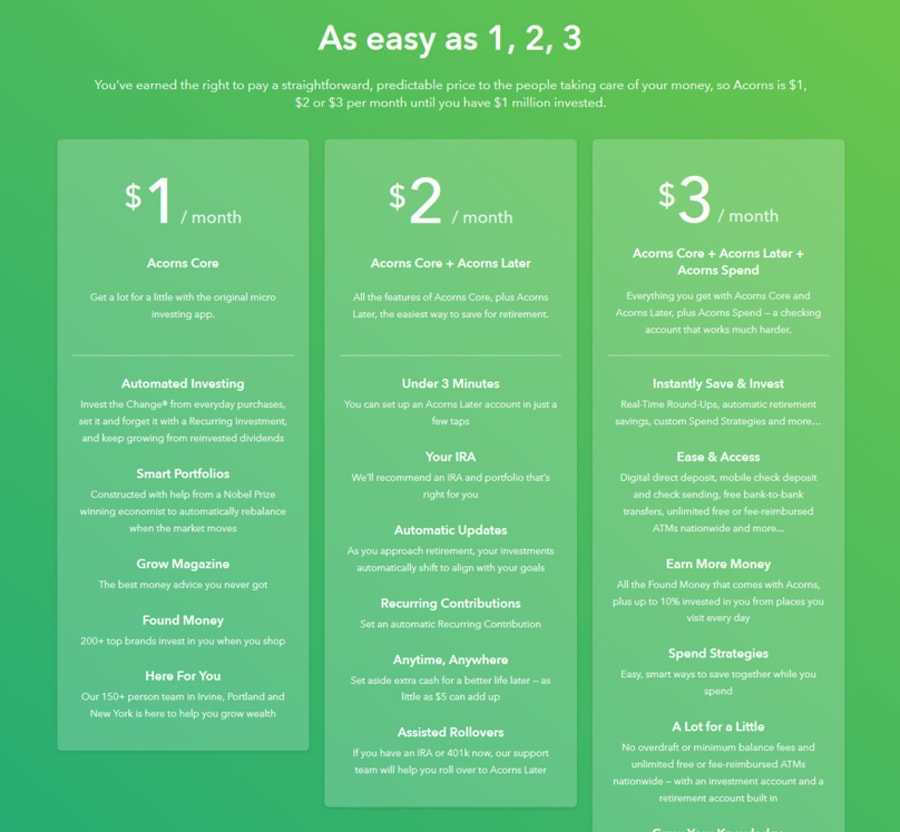

How much does Acorns cost?

The Acorns app has three pricing levels.

- Acorns Core costs $1 per month. It rounds up the purchase price to the next dollar, and the change is invested in your portfolio. Acorns Core is particularly suitable for college students.

- Acorns Core + Acorns Later costs $2 per month. This option gives you access to an IRA plan, which is tax-deductible.

- Acorns Core + Acorns Later + Acorns Spend costs $3 per month. This option adds a checking account with a debit card to the package.

How to get started with Acorns?

Creating an Acorns account

If you are new to Acorns, here are the steps you need to follow for registration. Start by downloading the Acorns app on your phone. Alternatively, you can sign up using the Acorns website. You are required to have a valid mail address, which Acorns will use as a channel to pass information to you.

To qualify for registration, you must be a resident of the United States or Australia and at least 18 years of age. The service is not currently available to residents of other countries.

- USAA

- US Navy Federal Credit Union

- Bank of America

- Wells Fargo

- Chase Bank

- PNC Bank

- Citi bank

If you do not bank with any of those, then you need to have a checking account.

Acorns does not accept postal and business addresses. You need to provide your permanent physical address.

You are also required to submit your social security number and expected to explain your financial goals during the registration process, as well as to provide full information about your occupation and income.

This information is essential as it allows Acorns to select and recommend the right portfolio for you. The next step involves verification of your identity, which can be done via a government-issued ID or another acceptable document.

It takes one business day for your account to get approved.

Investing with Acorns

The app makes it easy to log into your portfolio. You can monitor the performance of the market and your index funds. Acorns gives you a number of options for the basic index funds, which are offered by iShares and Vanguard.

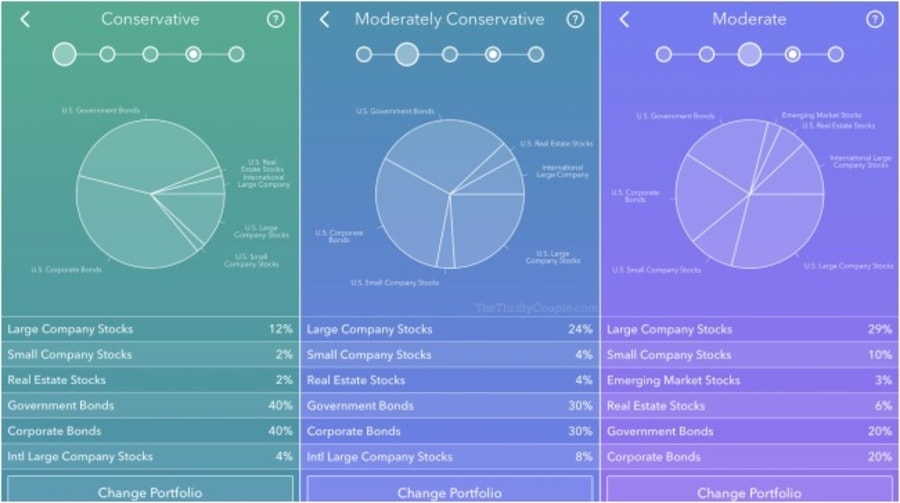

The asset classes covered are large companies, small companies, emerging markets, real estate, government bonds, and corporate bonds. When you invest, it is essential to be aware that there is no guarantee you will get returns.

Available investment portfolios

After you sign up and create an investment account, the Acorns app will recommend a portfolio for you based on different variables. They include your income, net worth, investment objectives, and age.

If you are not happy with the recommendation, you can select a portfolio that you think is the best fit for you. The Acorns app offers five types of portfolios: conservative, moderately conservative, moderate, moderately aggressive, and aggressive.

How user-friendly is the Acorns app?

You can easily access your Acorns account using any device because the information is stored in the cloud. The Acorns app is rated as friendly. It has a useful feature that enables users to monitor their portfolios. It also lets them easily find out the projected value of their accounts.

Risks with Acorns investing

The money Acorns receives from you is invested in stocks and bonds. Such investments tend to be risky because the market fluctuates. Short-term investments are typically riskier than long-term investments. Therefore, users are advised to go with long-term investments. Acorns takes into account the fact that investors have different levels of risk tolerance, so it offers a variety of portfolio types.

Generally, three factors determine the risk you are likely to take: the amount of money you have, the time you have, and your attitude to risk. The portfolios serve different functions. For instance, if Acorns recommends the conservative one, this means the user is not investing a lot of money. It may also have to do with age. People over 50 tend to take less risk compared to younger investors because they are nearing retirement.

Investing in Acorns does not mean buying stocks

When you invest in stocks, you acquire a piece of a company. This is not the case with Acorns because your money is invested in ETFs. These vehicles are collections of marketable securities that track an index. Individual investors usually like ETFs because of the lower fees, smaller risk, and fast cash. The Acorns ETFs represent the six areas of investment. It is important to note that the portfolios perform all the work involving the ETFs.

Checking on your investment

The best thing to do is to let your money work for you over a long period. Checking on your investment every day does not help at all. With Acorns, you usually invest cents, so it will take a long time for them to accrue. Constant checking tends to discourage because the figure seems stagnant. As a result, you may decide that your choice of the portfolio was wrong and keep jumping from one to another. Acorns encourages investments which produce better results after a long period.

Acorns for college students

College students wishing to open an Acorns account do not have to pay any fees. The only requirement is to have a valid .edu address. Under “employment status,” applicants are required to write “student,” which will last for four years from the date of registration.

Advantages and disadvantages

The pros of Acorns

- The monthly Acorns fee is modest for those with less than $1 million invested. Until they reach that threshold, users will be charged $1 per month for an Acorns Core account, $2 for Acorns Core + Acorns Later, and $3 for Acorns Core + Acorns Later + Acorns Spend.

- No minimum deposit is required. You can start with as little as $5, which removes the barrier for people with low incomes.

- The Acorns app is well-designed and simple to use. It guides your choice of an investment option and makes it easy to monitor the performance of your portfolio.

- Acorns is free to use for college students. They can use the app for four years without paying any fees.

- Acorns gives you an option to decide on the types of transactions to be included in the Round-Ups.

- With five portfolio types to choose from, Acorns gives investors enough options to ensure they can find a good fit.

- Acorns has a multiplier you can use to boost your Round-Ups and thus increase your investment.

- Through Acorns’ Found Money partners, you can have big companies contribute directly to your Acorns account when you shop with them.

The cons of Acorns

- It is risky. When you invest with Acorns, you must keep in mind that the market fluctuates, which means you may sometimes end up losing the principal.

- Acorns mainly help in boosting your savings. It may not help you achieve bigger goals.

- The monthly fee can be too much if you keep a small balance. For instance, if you decide to maintain the minimum balance of $5, paying $1 per month translates into 20% in terms of cost.

- Acorns has no tax benefits. It does not offer tax assistance to its customers apart from mailing them 1099 forms.

Criticism of Acorns

One user decided to close his Acorns account for the following reasons:

- A redesign of the app complicated matters for him, making it necessary to click in multiple places. After clicking, he had to wait for some time to see his returns, which he deemed a waste of time.

- Found Money does not benefit everyone.

- The monthly fee of $1 was expensive for him. He thinks the amount charged should be reduced. (source)

Acorns FAQs

Acorns FAQs

Who is eligible to sign up for an account?

Only residents of the United States and Australia can create an Acorns account. They should be at least 18 years of age and have a valid social security number.

What do I need to do to open an account?

You need to provide your first and last name, the exact date of birth, a valid email address, and your permanent physical address.

Is it possible for me to link my business account?

No, you cannot link your business checking account with your Acorns account. Acorns always complies with FINRA’s anti-money laundering regulations.

Why does it take so long for an Acorns account to get approval?

Acorns takes your security very seriously. Therefore, it must verify that the information you submit is true before approving your account.

What is the minimum amount required to open an account?

You are not required to have a minimum balance to open an account, but you need at least $5 in Round-Ups to start investing.

Conclusion

I recommend investing with the Acorns app. It does not matter if you have little money – just start small and give it time to grow. Acorns is the best when it comes to micro-savings.

See also: Best Short-Term Investments