What are the best indicators for day trading? There are numerous indicators available for use in day trading. These indicators can assist traders in identifying prospective trading opportunities and determining where to place stop-loss and take-profit orders.

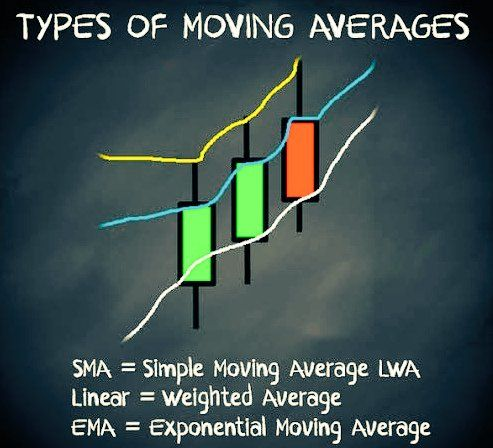

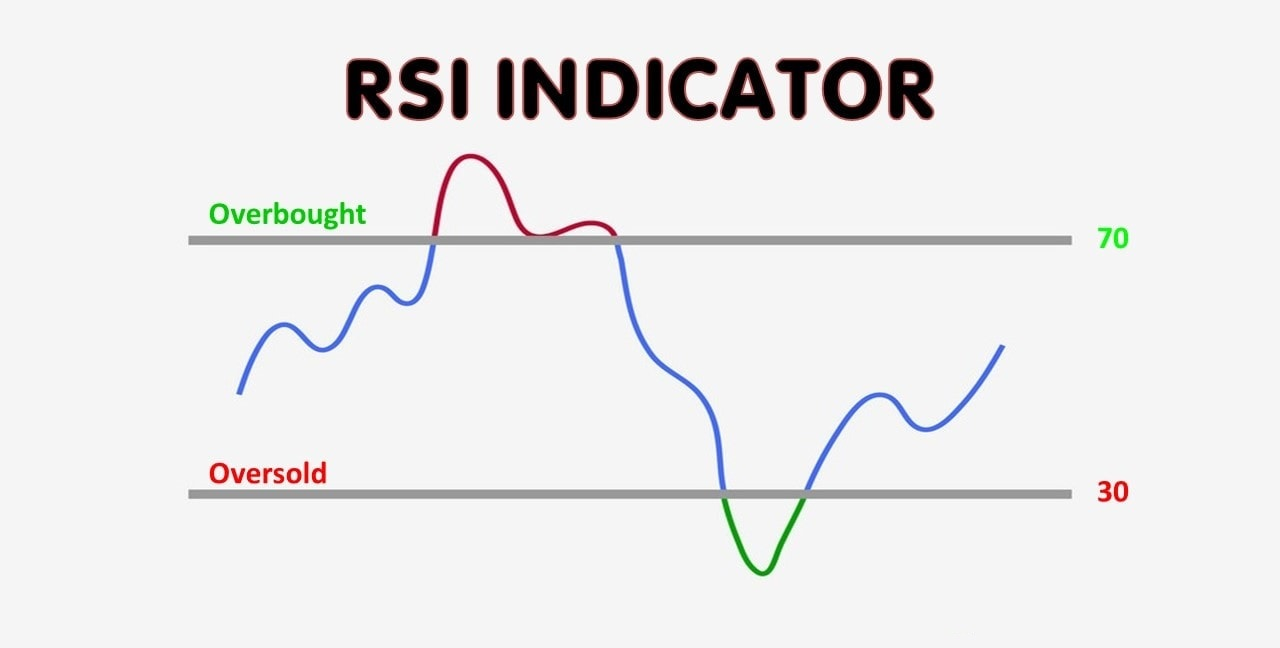

Moving averages indicator can help detect a market’s general trend, whilst Bollinger Bands® can highlight periods of high or low volatility. MACD can assist in identifying momentum, whereas RSI can assist in identifying overbought or oversold conditions.

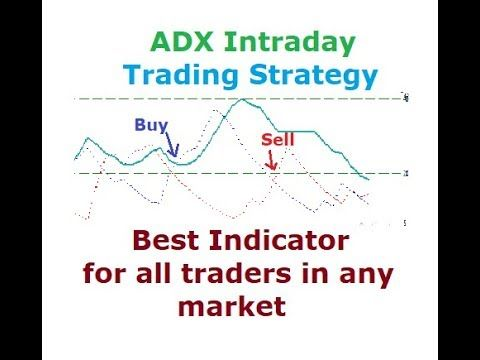

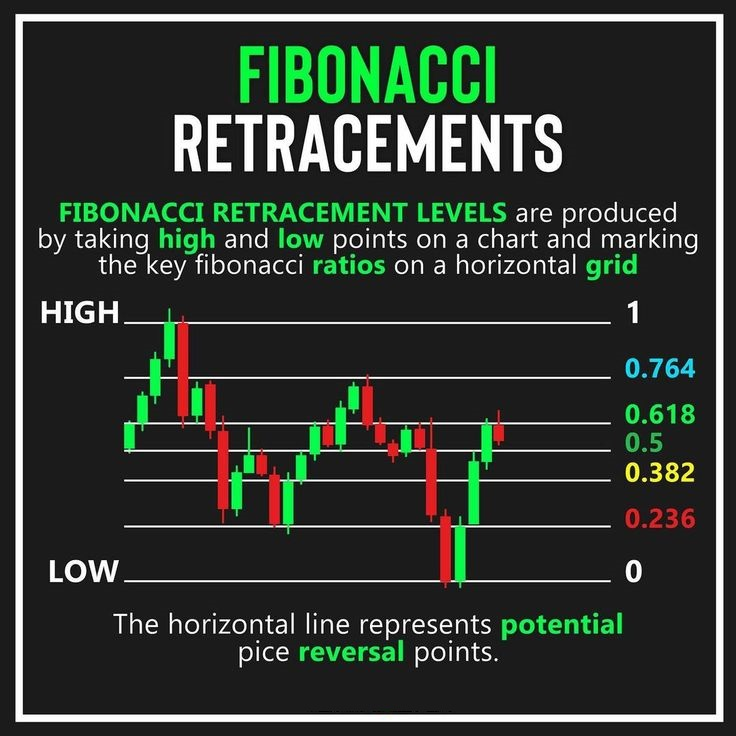

CCI, ADX, Fibonacci retracements, pivot points, and stochastics can all be used to trade selloffs, breakouts, or reversals. Each of these indicators has advantages and disadvantages, and it is necessary for traders to understand how they work before applying them in their trading.

Overall, these are some of the top-day trading indicators that are used mostly by traders. Traders can boost their chances of success in trading by learning how they operate and how to trade them.

Please scroll down and read below to learn more about the best way to make trading decisions.

Table of Contents

Some terms you may want to understand

The ACD principle

An overbought and oversold indicator is a technical indicator that is used to show when the market is overbought or oversold. The indicator is based on the average convergence divergence (ACD) principle.

The MACD and the OBV

Traders widely use the moving average convergence and divergence (MACD) indicator to produce buy and sell recommendations. Subtracting the 26-day exponential moving average (EMA) from the 12-day EMA yields the MACD. The resulting line is then shown on a separate graph, along with the MACD line’s 9-day EMA (the “signal line”). When the MACD line crosses above the signal line, a purchase signal is generated, and when the MACD line crosses below the signal line, a sell signal is formed.

Another common technical indicator traders use to produce buy and sell recommendations is the on-balance volume (OBV). The OBV is calculated by adding up days’ volume and subtracting down days’ volume. When the OBV line rises, a buy signal is generated; when the OBV line falls, a sell signal is generated.

Both of these technical indicators can give trading indications on any timeframe; however, they are most typically seen on intraday charts.

Trading signals

A trading signal is an alert that indicates when a trader should purchase or sell a financial asset. Trading signals can be generated using price trends & changes and volume-weighted average prices. Some signals are produced automatically, while human analyzers produce others.

See Related: Online Trading: Tips for Beginners

Best Indicators for Day Trading

The nine most popular and widely utilized indicators are as follows:

- Moving averages

- Bollinger Bands®

- MACD

- RSI

- CCI

- ADX

- Fibonacci Retracements

- Pivot Points

- Stochastics

1. What is the best way to trade moving averages?

A moving average is a fundamental and technical indicator that aids in smoothing price motion by filtering out “noise” from individual price bars. Traders can better detect the direction of the overall trend by applying a moving average. Moving averages are classified into several categories, the most popular of which are simple moving averages (SMAs).

Traders often invest when the price goes above the moving average and sell when the price goes below. The stop-loss is normally set just below or above the most recent swing low or high, and the take-profit is usually set at a multiple of the stop-loss distance (e.g., 2x or 3x).

When the price swings briefly above or below the moving average, it soon turns and returns to the prior trading range. Fake breakouts can be tough to detect, but a lack of momentum on the move is one clear indication.

2. Trading the Bollinger Bands®

Bollinger Bands® is a technical analysis method for evaluating market volatility. They are calculated by taking a moving average and then adding and removing statistical parameters from it. The Bollinger Bands® can be traded when the RSI moves beyond them. A stop-loss position can be set just below the most recent low, and a take-profit position can be set just above the most recent high. When the price breaks out of the Bollinger Bands®, it immediately reverses and falls back within the bands, which is referred to as a phony breakout.

See Related: PayPal Money Received Pending: Major Causes

3. How to Use the MACD Momentum Indicator

MACD is an abbreviation that stands for “moving average convergence and divergence,” and it is a technical indicator that traders use to assess momentum. MACD is generated by reducing the moving average (EMA) of 26 periods from the EMA of 12 periods. The MACD is a volume indicator.

Bollinger Bands® are 3 levels that serve as technical analysis tools. The center line is a simple moving average, with the upper and lower lines separated by two standard errors. Bollinger Bands® can be applied to trade stocks, futures, and currencies, among other markets.

When trading MACD, setting your stop-loss just below the most recent low is critical to avoid being trapped in a fake breakout. Support and resistance levels or Fibonacci levels can determine your take-profit level.

When the price breaks out of a Bollinger Band®, it immediately reverses and closes back within the band; this is known as a “false breakout.” This can be a tough pattern to recognize, but you may be able to notice it forming if you pay attention to volume.

4. How to Use the RSI, also known as the Relative Strength Index

A Relative Strength Index (RSI) is a technical indicator that measures the strength of a trend. It is derived by taking the average price of a security over a given time period. This class will teach you how to trade an RSI. To trade an RSI, first decide where to put the stop-loss and take-profit.

The stop-loss should be set at the most recent low, while the take-profit should be set at the most recent high. Fake breakouts, which occur when the price drops out of range but immediately reverses direction, must also be avoided.

See Related: Best Online Tutoring Jobs

5. CCI Trading Instructions

The CCI is a momentum indicator that can be used to detect both overbought and oversold market conditions. It can also be used to identify possible breakout trades. When trading with the CCI, it is critical to set your stop-loss below the recent low (for long bets) or above the recent high (for short trades) (for short trades).

You might position your take profit at a previous support or resistance level. To identify a fake breakout, look for price activity that does not corroborate the breakout. For example, if the price breaks out to the upside but the CCI does not rise, this could indicate that the breakout is not genuine.

6. How to Use the ADX in Trading

The ADX is a technical indicator used to determine a trend’s strength. A strong trend is normally characterized as an ADX value greater than 25, while a weak trend is typically described as an ADX value less than 20.

Many traders who trade with the ADX will seek periods when the ADX is above 25 and then enter long positions. Once in a long position, traders often set their stop-loss below the most recent low and look to exit when the ADX falls back to 20.

Divergences between price movement and the ADX are frequently used to detect a phony breakout. If the price is making new highs, but the ADX is not, this could indicate a fake breakout.

7. How to Profit from Fibonacci Retracements

A Fibonacci retracement is a technical analysis method used by traders to determine probable support and resistance levels. According to the theory, after a price move, the market will repeat a portion of that move before continuing in the same direction. Fibonacci levels are numerical ratios that can be used on any chart.

The most typical approach to trade Fibonacci retracements is to invest at a support level and sell at a resistance level. Stop-loss orders should be placed below or above support and resistance levels. Set take-profit levels at the next Fibonacci level or a prior high or low.

A “false breakout” occurs when the price surges strongly through a support or resistance level but then rapidly reverses course, trapping traders who open positions too early. Waiting for the price to close outside the Fibonacci level before starting a position is one way to avoid fake breakouts.

See Related: Fundamentals Things to Know When Investing in Gold Bullion

8. How to Trade Pivot Points

Pivot points are fundamental and technical indicators that are used to understand the market direction. They are calculated using the prior period’s high, low, and close prices. Pivot points can be used to determine potential levels of support and resistance for the current period.

Look for rebounds above or below the resistance and support levels while trading pivot points. A break over resistance signals a bullish trend, whereas a break below support signals a bearish trend. Depending on your trading direction, you can position your stop-loss above or below the barrier or support levels.

A fake breakout occurs when the market price reaches a resistance or support level and then reverses direction. Before placing a trade, wait for the price to break out and thereafter close above or below the level to avoid fake breakouts.

9. How to Trade the Stochastic Indicator

A stochastic is a technical analysis indicator that displays how the price of an asset has performed over time. It is based on the concept of “random walk,” which claims that stock values are unpredictable and do not follow any pattern.

For long positions, the stop-loss can be positioned below the most recent swing low, while for short positions, it can be placed above the most recent swing high. The take-profit might be positioned at a previous level of resistance or support.

A fake breakout happens when the price breaks through a level of support or resistance but then rapidly reverses and returns to the range. This can be difficult to detect, however one indication that it is occurring.

Conclusion

A few crucial signs might help you make the best selections when day trading.

- First, keep an eye on the market’s overall trend. Look for stocks that are gaining if the market is rising. Look for stocks that are falling if the market is falling.

- Second, keep an eye on momentum. This is when a stock begins to move in one way and continues to do so.

- Third, search for levels of support and resistance. These are the points that the stock is having difficulty breaking through.

- Finally, take note of the volume. This is the number of shares in a stock that is exchanged.

The greater the volume, the greater the interest in the stock. If you’ve been looking for indicators with automation as an expert advisor, read this.

FAQ

-

What is the best day trading platform?

Because individual traders have different interests and demands, there is no “optimal” day trading platform. Some platforms may be better suited for novice traders, while others may be more complex and appropriate for experienced traders. It is critical to select a platform that is user-friendly and fits your trading style.

-

How to make money day trading?

You must do a few things to make money during day trading. To begin, you must thoroughly understand the market in which you are dealing.

- You must understand what drives price movements to make intelligent trades.

- Second, you must have an effective trading technique. You cannot purchase and sell randomly; you must have a strategy for entering and exiting trades.

- Finally, you must be self-disciplined. Day trading can be risky, so adhere to your plan and don’t let emotions influence your actions.

If you can achieve all of these things, you have a decent chance of making money day trading.

-

Should I use an intraday trading indicator when trading during the day?

There is no clear solution to this topic because using indicators in day trading has both pros and cons. Some traders believe that indicators assist them in making better decisions. In contrast, others believe they simply add complexity and confusion. Finally, each trader must decide whether to use indicators in their daily trading.

-

What is day trading?

The practice of buying and selling stocks in the stock market on the same day is known as day trading. This is done to benefit short-term price movements in the stock market. Intraday traders commonly use technical analysis to determine when to purchase and sell stocks.

-

What is a technical indicator?

A technical indicator is a mathematical formula to assess historical market movements and forecast future price movements. Traders like technical indicators because they can assist them in spot trading opportunities and probable market reversals. There are numerous forms of technical indicators, each with its own formula. Popular technical indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

-

What is the most accurate trend indicator?

No one-size-fits-all response exists to this topic because the optimal trend indicator will differ depending on the market and trading technique chosen. Moving averages, momentum indicators, and support and resistance levels are some common trend indicators.

-

Do you know which technical indicators to use?

Because there is no perfect technical indication for all scenarios, it is critical to grasp each’s strengths and shortcomings before making a choice. Some indicators are better at detecting short-term trends than others, while some may be better suited for longer-term research. Finally, the best way to determine which technical indicator to utilize is to try a couple and discover which ones perform best for your trading style.